Free for any use. MALAYSIA KLCI LATEST ANALYSIS Latest dividend stock analysis due to the Covid-19 situation.

India S Government Delights Businesses By Slashing Corporate Tax The Economist

To address this in 2017 the Central Bank of Ireland created modified.

. However the survey of 1296 executives across 53 countries and regions found a rising threat from external perpetratorsbad actors that are quickly growing in strength and. Corporate tax individual income tax and sales tax including VAT and GST and capital gains. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP.

Service Tax Digital Services Amendment Regulations 2022. Zeroing in on investor expectations A MICPA-PwC Malaysia survey Accelerating the net zero transition. 15 Nov 2018 0957 PM Post 23.

6 to 30 characters long. The list focuses on the main types of taxes. Total Shares Quantity 876B.

1st July 2018 Trading Participant Circular No. Food Processing Ingredients Market by Type. This page provides - United States Corporate Tax Rate - actual values historical data forecast chart statistics economic.

2 days agoMany of the leading GDP-per-capita nominal jurisdictions are tax havens whose economic data is artificially inflated by tax-driven corporate accounting entries. Fraud alert text appearing to be from your bank will get your attention but it could be a scam. Name Shares Position Change.

Were transparent about data collection and use so you can make informed decisions. Crude Oil Production in Malaysia increased to 513 BBLD1K in June from 484 BBLD1K in May of 2022. 2022-5-31On the basis of the most favoured nation clause between Switzerland and India the residual tax rate in the source state for dividends from qualified participations is reduced from 10 to 5.

When we collect. Start creating amazing mobile-ready and uber-fast websites. 2021-12-9Improving Lives Through Smart Tax Policy.

The proportion of organisations experiencing fraud has remained relatively steady since 2018. Tax Accounting. List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

Drag-n-drop only no coding. Crude Oil Production in Malaysia averaged 65459 BBLD1K from 1993 until 2022 reaching an all time high of 791 BBLD1K in October of 2004 and a record low of 461 BBLD1K in October of 2021. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

This page provides the latest reported value for - Malaysia Crude Oil Production - plus. Nov 2018 Male MYS. 2022-10-19Get the latest international news and world events from Asia Europe the Middle East and more.

Statutory corporate income tax rates. The Corporate Tax Rate in the United States stands at 21 percent. Dec21 Malta 35.

2022-9-17Outlook puts you in control of your privacy. Financial Tax reports. Home page add your press release.

PwCs Global Economic Crime and Fraud Survey 2022 shows good news. Forecasts statistics and historical data charts for - List of Countries by Corporate Tax Rate. Embracing the ESG revolution.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Entries Open Online for Home Goods Art Crafts Livestock Entries at 2019. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

Net Profit - Record-high quarterly profit after tax. 2022-10-18Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. Sales Tax Exemption Under Schedule C Sales Tax Persons Exempted From Payment Of Tax Order 2018.

In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Corporate Responsibility Report 2018 2017 Corporate Responsibility Report 2017 2016 Corporate Responsibility Report 2016. Share price at 1635 267600.

ASCII characters only characters found on a standard US keyboard. Sustainable Business Diversity Equity and Inclusion reports. Said amendment applies retroactively since 5 July 2018.

2022-9-19Consequential to the Issuance of the Securities Commission Malaysias Guidelines on Contracts For Difference Guidelines Annexure 1 Amendments to the Guidelines. 2022-9-14The Corporate Tax Statistics database is intended to assist in the study of corporate tax policy and expand the quality and range of data available for the analysis of base erosion and profit shifting BEPS. Perimeter Intrusion Detection Market Poised to Expand at 143 CAGR During 2018 - 2028.

Amendments to the - 1. The DTT applies since 1. Must contain at least 4 different symbols.

We dont use your email calendar or other personal content to target ads to you. MOBIRISE WEB BUILDER Create killer mobile-ready sites. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

We help you take charge with easy-to-use tools and clear choices. Total Shares 7375. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

OECD member countries April 2021 inclusive framework data July 2021. Four priorities for business The world needs to reduce the carbon intensity of economic activity by 152 a year 11 times faster than the global avg. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP. 2021-12-9Improving Lives Through Smart Tax Policy. Is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs.

Download Mobirise Website Builder now and create cutting-edge beautiful websites that look amazing on any devices and browsers. Tax Accounting. Dec22 Maldives 15.

An entity which provides insurance is known as an insurer. Annexure 2 Amendments to the Directives Effective. Corporate Tax Rate in the United States averaged 3227 percent from 1909 until 2022 reaching an all time high of 5280 percent in 1968 and a record low of 1 percent in 1910.

For instance the Irish GDP data above is subject to material distortion by the tax planning activities of foreign multinationals in Ireland. 2 days agoA comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

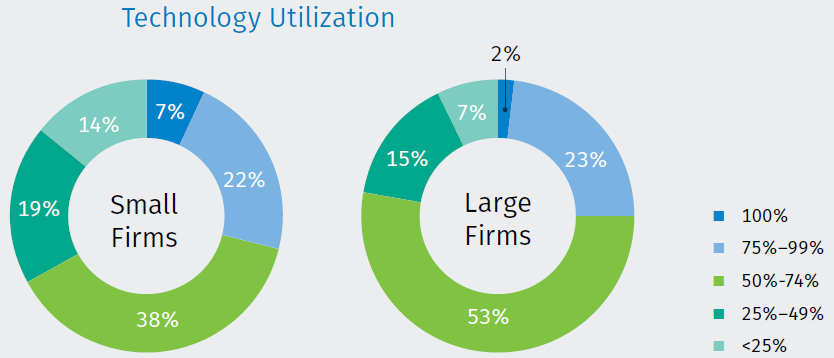

Survey Tech Is The Path To A Better Tax Season Cpa Trendlines

Acca P6 Sept Dec 2018 Q Qqqqqqqqqqqqqqqqqqqqqqqqqq Applied Skills Taxation Malaysia Tx Mys Studocu

How Important Is Tax Competition To India International Tax Review

Malaysia Scraps 6 Consumption Tax To Meet Election Pledge Bloomberg

![]()

Malaysia Corporate Tax Rate 2018 Businesses Need To Know

New Malaysia New Taxes The Star

Malaysia Gst To Be Scrapped Following Election

Income Tax Malaysia 2018 Mypf My

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

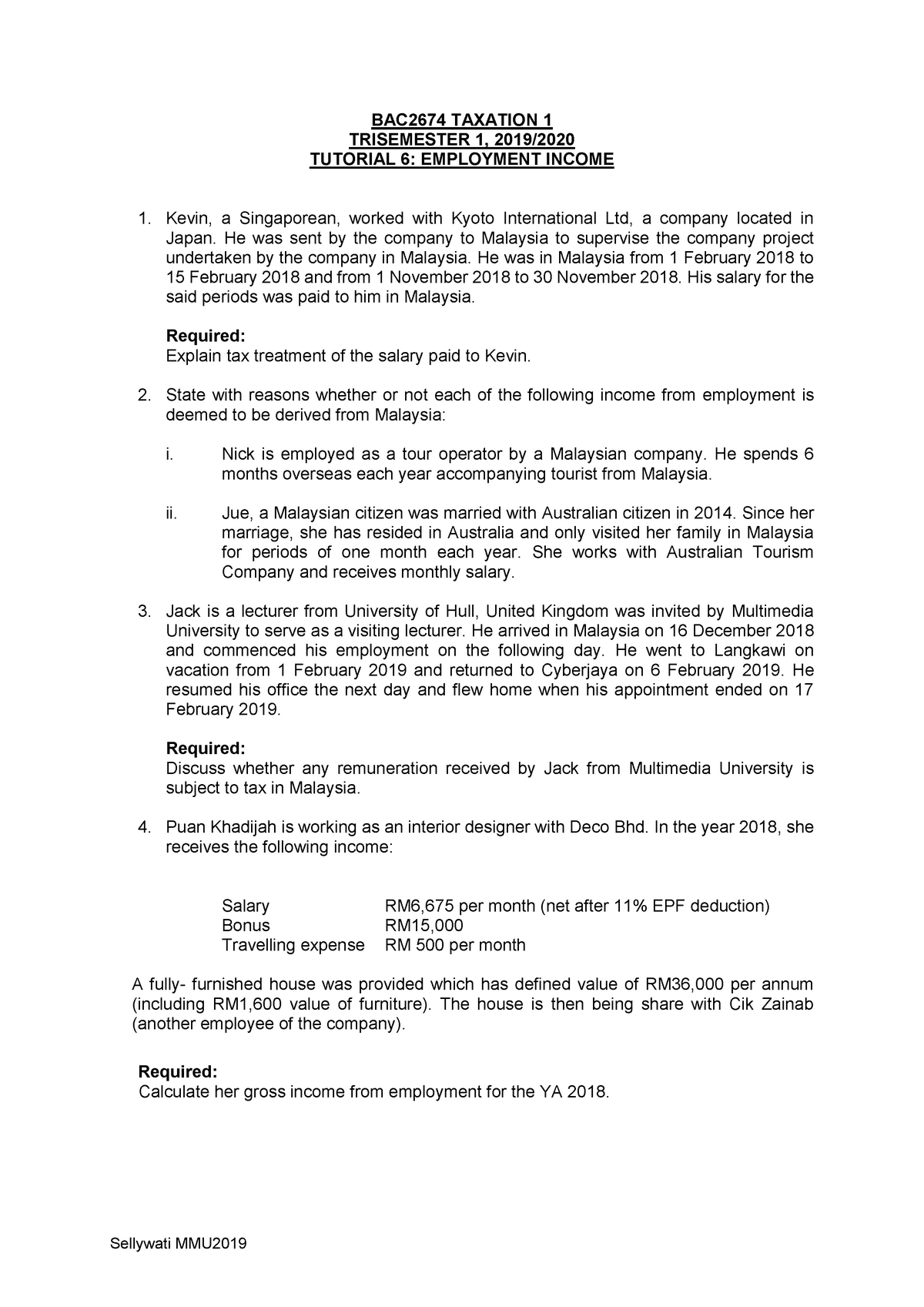

292081 Tutorial 6 Employment Income I Sellywati Mmu Bac2674 Taxation 1 Trisemester 1 2019 Studocu

/do0bihdskp9dy.cloudfront.net/02-05-2022/t_ea5f75078d2e49d38697211d45b551b8_name_file_1280x720_2000_v3_1_.jpg)

Kansas Plan To Lure Big Project Snags On Corporate Tax Cuts

Malaysia Post Election Income Tax And Gst Updates Cheng Co Group

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Malaysia Corporate Tax Rate 2022 Take Profit Org

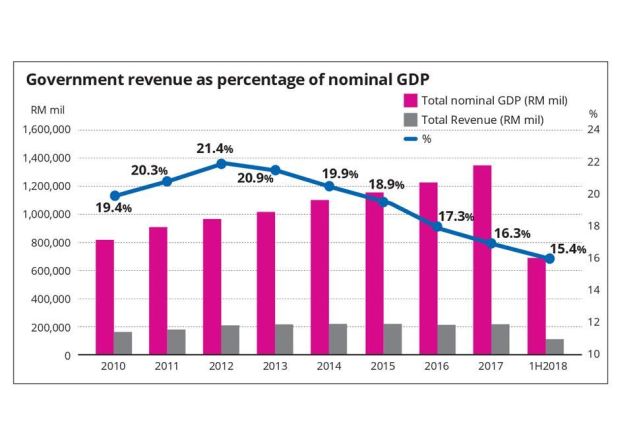

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Corporate Tax Rates In Asean As Of 31 St Of December 2018 Download High Resolution Scientific Diagram